- Cryptocurrencies arrived at the global investment scene in 2009 and got real momentum from 2013. During the next five years, more than 1500 various cryptocurrencies were launched.

- In 2017, the cryptocurrency market saw a massive growth of 4000%, which provided lucrative options for both mass retail investors and VC firms.

- Current crypto investment trends show the surge of cryptocurrencies such as Ethereum, Litecoin, Ripple, and Stablecoin. The total crypto market cap is now at $341.63 billion.

Source: Unspash.com

Cryptocurrencies Since their Inception

When it comes to the future of cryptocurrencies and crypto investment trends, many experts have expressed their optimism, and some are simply dismissing it as a hype that will pass.

In 2009, Bitcoin burst into the scene as the first cryptocurrency. Since 2013, the crypto market has been witnessing a massive growth where over 1500 different cryptocurrencies were launched within 5 years.

It was in 2017 when the crypto market truly exploded with nearly 4000% growth in cryptocurrencies. As of October 5, 2020, the global crypto market capitalization is $341.63 billion.

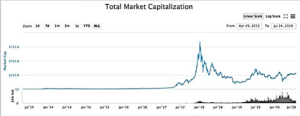

The chart below shows the cryptocurrency growth trends over the years:

Crypto Market Cap Trends (Source: Bitdegree.org)

The crypto investment trends are not just about Bitcoin anymore as there are various other products that have come up, including Litecoin, Ethereum, Litecoin, and Stablecoin.

Most Prominent Crypto Investment Trends

Bitcoin (BTC)

Most people may probably know about one cryptocurrency as of now, which is Bitcoin. This cryptocurrency is the oldest and still the biggest on the market holding a 40 percent share of total crypto market capitalization.

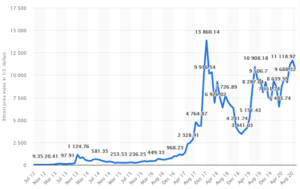

The average pricing of one bitcoin was nearly $10,728.25 by the end of September 2020.

Bitcoin Price Index (Source: Statista.com)

Recently, Bitcoin has been split into two cryptocurrencies: Bitcoin and Bitcoin Cash. Investors who were aware of this major change and invested before the split, gained nearly double their investment.

Ethereum (ETH)

Ethereum is the second-largest cryptocurrency after Bitcoin, which provides open access to digital money.

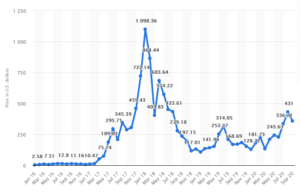

Towards the end of September 2020, the price of one Ethereum was $358, and its market cap came down to $40.6 billion.

Ethereum Price Index (Source: Statista.com)

Considering the trending of Ethereum, users can decide whether investing in it is a good idea. The recent trends show that the price of Ethereum is surging since May 2020, and it is a positive sign.

Litecoin (LTC)

In recent years, Litecoin has come up as one of the major crypto investment trends. It is the fifth-largest cryptocurrency with a market cap of nearly $11 billion.

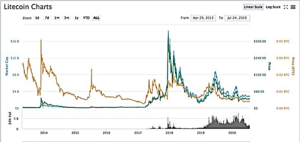

Litecoin reached its highest price in February 2018, which was $216.56 per coin. In September 2020, the price came down to $46.24 per coin.

The chart below shows the sharp rise in the price of Litecoin from 2018.

Litecoin Price Index (Source: Bitdegree.org)

Investors continue to show their interest in Litecoin due to its close connection to Bitcoin. Although the pricing showed a downward trend since 2018, still investors have enough reason to put their money in it for consistent returns in 2020 and beyond.

Ripple (XRP)

Ripple or XRP is one of the major cryptocurrency trends since its whopping growth of nearly 36,000% in 2017! In that year, XRP began from almost $0 and notched up to reach $2.4 by December.

The price of XRP dropped to $1.60 in 2018. On October 2, 2020, its price was $0.2338, and the total market cap of XRP is $10.84 billion.

XRP Price Trend (Source: Coinmarketcap.com)

One of the main updates about XRP is that many major financial institutions such as JP Morgan, American Express, and Santander have already incorporated Ripple’s technology.

Stablecoin

The purpose of launching stablecoin is to address the high fluctuations of traditional crypto-assets (e.g., Bitcoins), by tying their value to single or multiple assets.

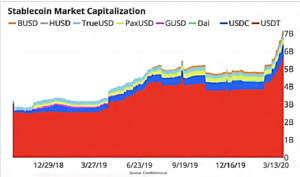

Right now, the most talked-about stablecoin is “Libra,” the asset-backed digital coin from Facebook. After overcoming the downturn in the Mid-March of 2020, stablecoin is capturing over 70 percent of BTC trades these days.

Stablecoin Market Cap (Source: news.bitcoin.com)

Currently, eight stablecoins have a total market valuation of more than $7 billion. Those are BUSD, DAI, GUSD, HUSD, PAX, TUSD, USDC, and USDT. Most of the $7 billion stablecoin valuations come from USDT’s market capitalization.

Venture Capital (VC) Investment Trends

Venture Capital initiatives have been one of the major crypto investment trends as many crypto-friendly investors are making a beeline.

Some of the prominent crypto-only investing firms include Digital Currency Group, Polychain, Pantera, Frontier tech accelerators (Boost VC at #2), and other VC firms.

Among these VC firms, Digital Currency Group is one of the early companies to have invested in in the blockchain space. In 2019, the firm supported four companies, including a $65M Series B to Figure Technologies. The company also backed up Staked, Livepeer, and CoinFLEX.

Another major firm, Boost VC has invested in almost 50 blockchain companies during the past five years. Besides, firms like Bitmain, which is said to be the second well-funded crypto firm it has backed Coinbase with $450 million of raised capital.

Industries that are Witnessing Major Crypto Investment Trends

Financial Services

Financial services are one of the major sectors that will see significant investments in crypto technology. Even though other sectors seem to be catching up now, the finance industry will remain the focal point in terms of crypto trends.

In 2019, projects like Calibra, Libra, J.P Morgan’s stablecoin, and the digital currencies of Interbank Information Network, the European Central Bank, and The People’s Bank of China were dominant.

Even in 2020, despite the shadow of COVID-19, there is likely to be a steady increase in investments by financial services companies.

Banking and Payment Industry

In the banking and payment industry, cryptocurrency technology is allowing financial access to users across the world and minimizing their over-reliance on traditional banking/transaction systems.

Users can now complete regular transactions, including payments, fund transfers, lending/borrowing, and even exchange of products (or services) on various cryptocurrency platforms without using an intermediary bank or payment system.

Life Sciences and Healthcare

Investments in crypto technology can have a profound impact on the life sciences and health care industry in terms of data transparency and speed of access, traceability, and reliability.

The possibility of implementing crypto technology in pharmaceutical supply chains and clinical trials have been major focus points. Another crucial development will be digitizing health records, which is currently a challenging task for hospitals and clinics due to manual intervention.

Pharmaceutical Industry

The rise of Bitcoin, Ethereum, and other cryptocurrencies can provide great value to the pharma industry, as they are not under the regulations of any banks or government-backed financial institutions. For example, Hashed Health is a crypto-based healthcare provider that is initiating to integrate all healthcare companies and their credentials with cryptocurrencies.

Marijuana and the Pot Industry

The surge of cryptocurrencies has also resulted in boosted stock prices of marijuana and pot companies. As this industry is still illegal in many US states, banks do not usually approve debit and credit cards to pot and marijuana firms.

In such a scenario, cryptocurrencies can solve capital investment and funding issues for the marijuana and pot industry through Initial Coin Offerings (ICOs). Some of the major cryptocurrencies related to this industry are PotCoin (POT), CannabisCoin (CANN), Receipt (PRG), HempCoin (THC), Tokes (TKS), and others.

Before We Go

Source: Unsplash.com

The events like COVID-19 may have disrupted the crypto market in 2020; still, we may see trends like alliances of fintech and crypto, market consolidation with the mainstream finance, and government intervention in the coming years. We can hope that these trends will streamline the crypto market for both investors and users in terms of profitability and stability.