- The overall BTC holding of the global private firms surged after February 2021.

- MicroStrategy, a prominent BI organization, is bullish on BTC with an AUM worth over $6 Billion.

- BTC holding of private firms increased by 400% in just a year.

Source: Bitcoin.com

The BTC amount held by private firms surged dramatically in 2021, building on the gains of the previous year.

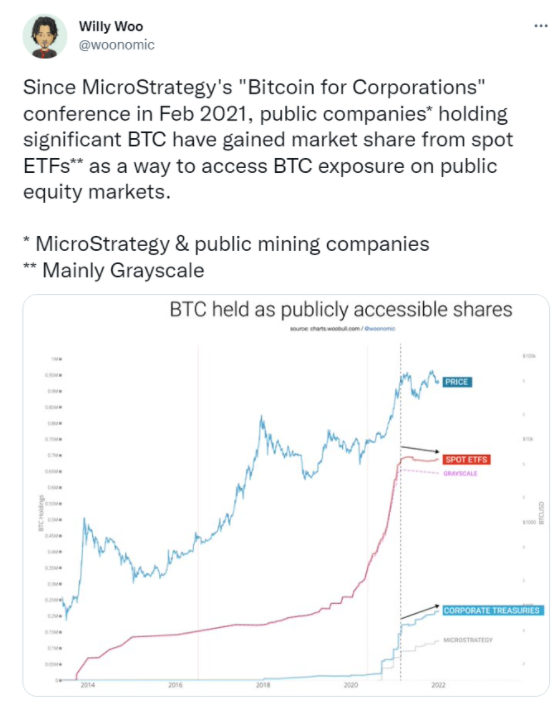

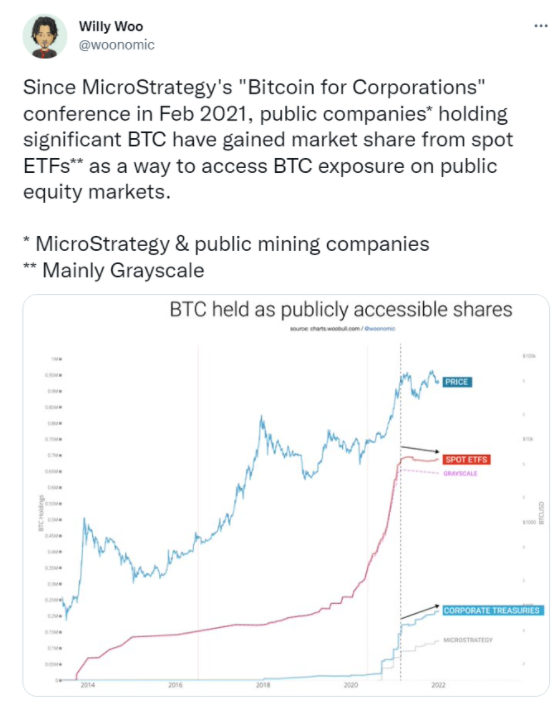

Willy Woo, an on-chain expert, said in a Monday tweet that the global public businesses with “substantial BTC have gained market share from spot ETFs as a way to obtain BTC exposure on public equities markets.”

Source: Twitter.com

This has been increasingly apparent since MicroStrategy’s “Bitcoin for Corporations” conference on Feb. 3 and 4, 2021. The online session’s primary aim was to discuss the legal implications for businesses looking to incorporate Bitcoin into their operations and reserves.

MicroStrategy, a significant BI organization with Michael Saylor as the founder, is highly bullish on Bitcoin, with around $6 billion in crypto AUMs.

On Thursday, Saylor’s firm, MicroStrategy, bought 1,914 more BTC worth $94 million. After August 2020’s initial Bitcoin acquisition, Microstrategy’s Bitcoin holdings have gained more than $2.1 billion in value.

Woo gave reference to a chart of BTC holdings inside public company treasuries and the exchange-traded funds (ETF) available for public ownership via stock markets based on crowdsourced corporate treasury data.

Spot ETFs contain BTC rather than futures purchased through contracts on the Chicago Mercantile Exchange futures market.

The Current Leaders Among Public Companies in Terms of Bitcoin Holdings

As per the data, Grayscale, an organization that manages digital currency assets, had a landslide market share worth 645,199 BTC by the end of 2021. As per the graphics, this accounted for 71% of the overall market, with total holdings of all spot ETFs and businesses totaling 903,988 BTC.

As per the Bitcoin Treasuries, MicroStrategy stands to be the largest corporate investor, with 124,391 BTC worth $5.8 billion. Tesla stands in second place with over 43,200 BTC, worth about $2 billion at current pricing.