- On March 19, 2021, Cardano (ADA) got listed on Coinbase. This listing increases the open interest on Cardano’s futures contracts by over $1 billion.

- After this listing, Coinbase customers can buy, sell, convert, and transact ADA tokens.

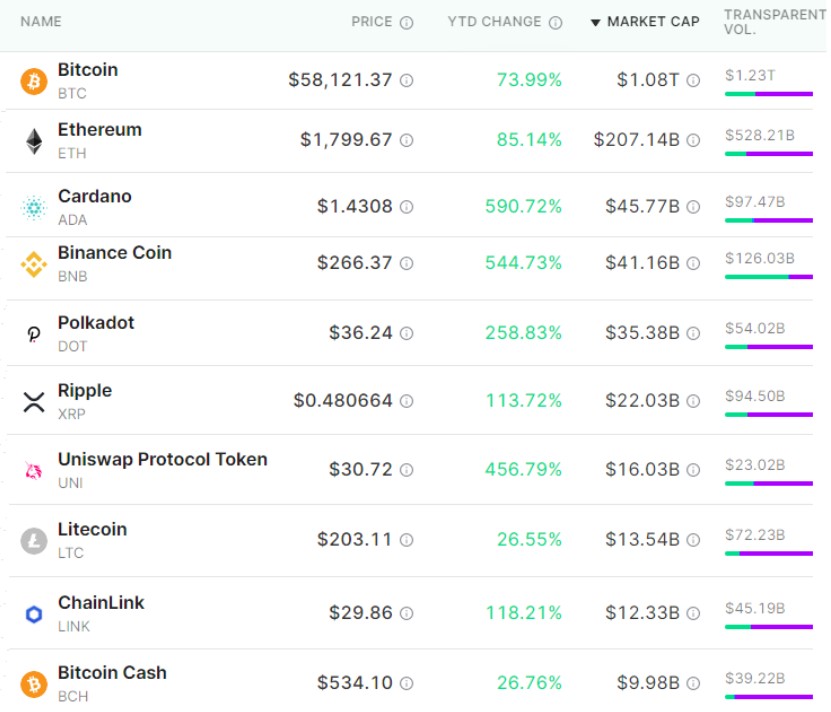

- ADA has become the third-largest cryptocurrency in the market after Bitcoin (BTC) and Ethereum (ETH), with a market capitalization of $41.9 billion.

From March 19, 2021, Coinbase began supporting Cardano (ADA) on Coinbase.com, Coinbase Android, and iOS apps. Coinbase customers can now buy, sell, send, receive, convert, or store ADA, which is available in all Coinbase-supported areas.

Just to remind the readers that Cardano or ADA is an open-source and cryptocurrency-based platform that runs on a protocol called “Ouroboros” or “proof-of-stake consensus.” This platform is developed around the Haskell programming language.

Currently, ADA is the third-largest cryptocurrency and has a market capitalization of $41.9 billion.

Earlier, Cardano (ADA) had an impressive beginning to 2021 as it broke through the $1 ceiling and reached an all-time high rate of $1.50, making it one of the major cryptocurrency development trends in recent months. The whooping 590 percent year-to-date (YTD) gain happened as Cardano turned into a multi-asset network.

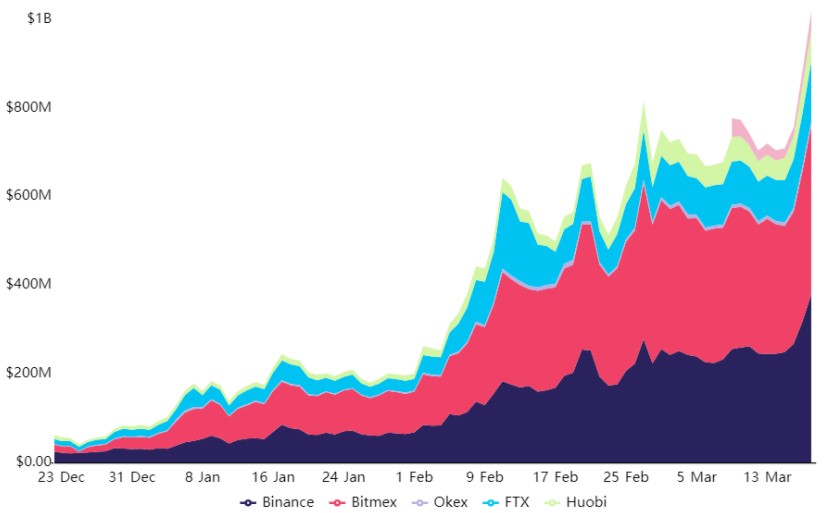

The Coinbase Pro listing of ADA triggered a renewed spike to $1.47 on March 18. The listing also helped Cardano push the open interest on its future contracts over $1 billion.

The users of the ADA token had long been clamoring for a Coinbase listing. The founder of Cardano, Charles Hoskinson welcome this listing, stating it as a “significant milestone” in Cardano’s development process.

The hopes are high around Cardano considering that before this, only (BTC) and Ether (ETH) could achieve the feat of reaching the $1 billion open interest milestone. Interestingly, Ether held a $2 billion open interest just 3 months back.

ADA Trading Volume and On-chain Metrics Got Stronger

As Cardano’s price goes up, so does its spot trading volume as well as on-chain transfers, surpassing Litecoin (LTC). Since investors are showing more interest in Cardano, it led to a spike in Cardano’s futures contracts open interest by five-fold in 2021.

A few days into its listing on Coinbase Pro, Cardano’s ADA (-0.39%) was available to Coinbase retail traders. No matter how the price moves, low trading activities may show a small user base or a lack of new investors. Although, in the coming days, Cardano’s volume could be among the top 5.

The Nomics transparent exchange volume shows that overall ADA had a trading volume of $97.5 billion in 2021, going past Litecoin, Ripple (XRP), and Polkadot (DOT).

In recent times, Cardano’s strength is in full display as its average transactions and network daily transfers are $4.5 billion per day. This volume of transaction is at least six times higher than the rest of the competitors.

On the other hand, VORTECS™ data also started tracing ADA’s bullish trading trends on March 16, before the recent spike in its price.

VORTECS™ score vs. ADA price (white). (Source: Cointelegraph Markets Pro)

According to the above chart, the VORTECS™ had a high score of 66 on March 16, just 12 hours before the announcement on the Coinbase listing came out. Since then, ADA had a sharp increase to $1.23, gaining 18 percent.

_____________________________________________________________________________

References:

https://cointelegraph.com/news/cardano-s-1b-futures-open-interest-shows-ada-is-a-serious-contender

https://blog.coinbase.com/cardano-ada-is-now-available-on-coinbase-dd30c1e0d93a

https://www.coindesk.com/cardano-ada-coinbase-listing