- A stablecoin is a type of cryptocurrency that has relatively low market fluctuations. Stablecoins achieve stability by backing up each coin with a stable asset like USD dollar.

- In the highly volatile cryptocurrency market, stablecoins provide much-needed stability to investors. The significance of stablecoin became even more evident after the sudden surge and fall of bitcoin in 2017.

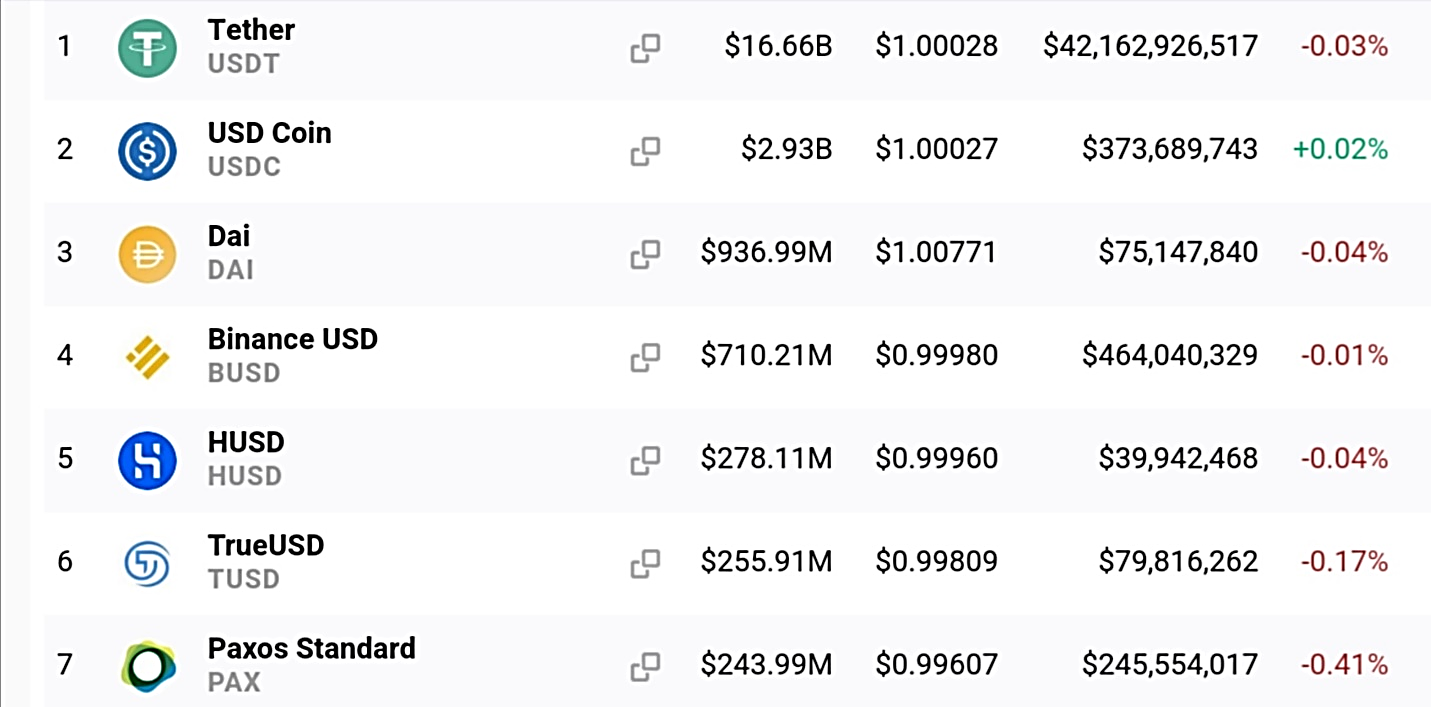

- Currently, the top stablecoins in the market are USDC, Tether, TrueUSD, Binance USD, Paxos Standard, and more. The current market cap of stablecoins is $22.46 billion.

Source: Pexels.com

Stablecoin in the World of Cryptocurrency

Cryptocurrencies are highly volatile, and that is the reason why mainstream participation by investors is limited. A Stablecoin is a type of cryptocurrency that has low volatility, and one of the ways to achieve low volatility is backing up the coin with a stable asset.

Stablecoins have been growing in popularity since the 2017 crypto craze. After the surge of bitcoin to nearly $20,000, it dropped by over 50 percent, which forced investors to sought lesser volatile crypto. Currently, the market cap of stablecoins is $22.46 billion.

Stablecoin volumes are particularly useful for investors who wish to have assets in the crypto space. Since switching from crypto to fiat currency can be an expensive and time-consuming process, stablecoins provide investors both a stable asset and a fast transactional speed.

Due to their relative stability, stablecoins also have better compliance with regulators. The Paxos Standard (PAX) and the Gemini Dollar (GUSD) are two examples of stablecoins that are approved by the New York State Department of Financial Services (NYSDF).

Stablecoin Price Trend (source: Cryptoslate.com)

Best Stablecoins (Volumes) in the Market and Why?

Here are the best stablecoins in the crypto market, which are different from each other based on the asset that backs them.

1. USDCoin (USDC): Coinbase

USDCoin by Coinbase and Circle is a fiat-collateralized digital currency and one of the top cryptocurrencies in terms of stablecoin volumes. Coinbase is a leading and one of the most popular crypto exchanges that have been instrumental in the popularity of USDCoin.

The underlying structure of the USDC token is based on an Ethereum-based token, and its distribution occurs on the Ethereum blockchain. One USDC represents 1:1 compared to one US dollar. For issuing and redeeming USDC tokens, an ERC-20 smart contract is required.

- Users willing to acquire USDC can transfer US dollars to the bank account of the USDC issuer.

- The token issuer issues the specific number of USDC tokens through the USDC smart contract.

- Users receive their USDC tokens while their US dollars remain in the reserve.

USDC is a popular stablecoin that has a high volume, and this is why it tops this stablecoin list.

2. PAXOS Standard: Paxo

PAXOS Standard is the second on the list. On average, this stablecoin has a 24-hour trading volume of nearly $250 million. Users can get PAX at a 1:1 ratio with the US currency. The PAX stablecoin is available on the Ethereum blockchain, which can be stored in any Ethereum wallet that is compatible with the ERC-20 protocol.

Paxos is registered under the New York State banking law, and it intends to make profits using investors’ funds. Paxos portrays itself as a reliable keeper that safely reserves the deposited funds of users and ensures that every PAX has 1:1 ratio with the US dollar.

3. TrueUSD (TUSD): TrustToken

TrueUSD is a fiat-collateralized stablecoin on the Ethereum blockchain. TrustToken is the platform that issues this stablecoin, along with creating various asset-backed token options. The company also offers different types of stablecoins, including TAUD, TGBP, TCAD, or THKD.

TrueUSD is a fully collateralized and legally protected USD-backed ERC20 stablecoin. This stablecoin uses various escrow accounts to lower the risk factors and to provide legal protections to token-holders against misappropriation.

Users wanting to buy TUSD will need to go through the KYC and AML process first. After the verification of identity, users have to transfer funds to a third-party escrow account. Similar to USDC, a smart contract regulates new TUSD tokens.

4. Tether

Tether (USDT) is another fiat-collateralized stablecoin with a 1:1 ratio, which means every USDT is equivalent to one US dollar.

The Bitcoin blockchain issues Tether tokens using the Omni Layer Protocol. It is a stablecoin with steady pricing and has a low risk. If you check the current price graph, you will find that Tether has been doing great by keeping its value around $1.00.

The main purpose of Tether is to act as a gateway between cryptocurrencies and fiat. Investors willing to initiate a trade but are tentative to use a centralized exchange can keep their fiat money with Tether tokens.

Besides, Tether stablecoin is also an easy gateway for new altcoin users. These users often cannot buy altcoins directly using fiat money, and they can now convert their fiat money into stablecoins and buy altcoins.

5. Binance USD (BUSD)

Binance launched BUSD stablecoin on September 5, 2019. This coin has a 1:1 with US dollars. According to the company, the purpose of developing BUSD is to unlock more financial services for an even better blockchain ecosystem by issuing this stablecoin, along with more use cases and utility through stable digital assets.

Currently, Binance offers savings products through which users earn interests on their locked tokens. Besides, BUSD plays a crucial role in the crypto platform when it comes to fees. Users who possess Binance USD need to incur lower fees for transactions. Simply put, Binance has done a great job by unlocking more financial instruments through the creation of Binance token.

Before We Go

Source: Pexels.com

Most crypto investors are aware of the fact that having a few stablecoins in their portfolio is a nice way to diversify and protect themselves from market fluctuations. Those who are actively trading volatile altcoins can also use stablecoins to quickly switch from declining assets and buy again at a better price.

The bottom line is stablecoins function as another key financial vehicle for the digital transformation of money. Stablecoins can provide both stability and liquidity to markets of exchange, act as a medium of exchange to avoid high market fluctuations for investors, and protect their physical assets in the digital platform.