- The reported volume of bitcoin gives a clear picture of the market. A more exact indicator is the Bitcoin moving to and from particular derivative exchanges.

- We must understand that institutional investors are at the initial stage and are pouring money into the bitcoin market. However, the retail buyers and sellers are maintaining a stronghold.

- The stability that bitcoin has shown this year makes it look way too lucrative, and it has further piqued the interest of institutional investors.

Bitcoin: Institutional vs Retail

The second awakening that the Bitcoin market is witnessed at the end of 2020 is nothing short of a fairytale. The previous high for Bitcoin was 20K dollars, and this year it has already broken through $40k. The rise begs experts to answer one pertinent question: is there an institutional interest, or is this just a retail phenomenon?

In general, the record bitcoin options values indicate an institutional interest, but there are many other factors that one must consider before arriving at any conclusion. Many factors are capable of answering this in a more detailed and explicit way. The ones which have a major impact are

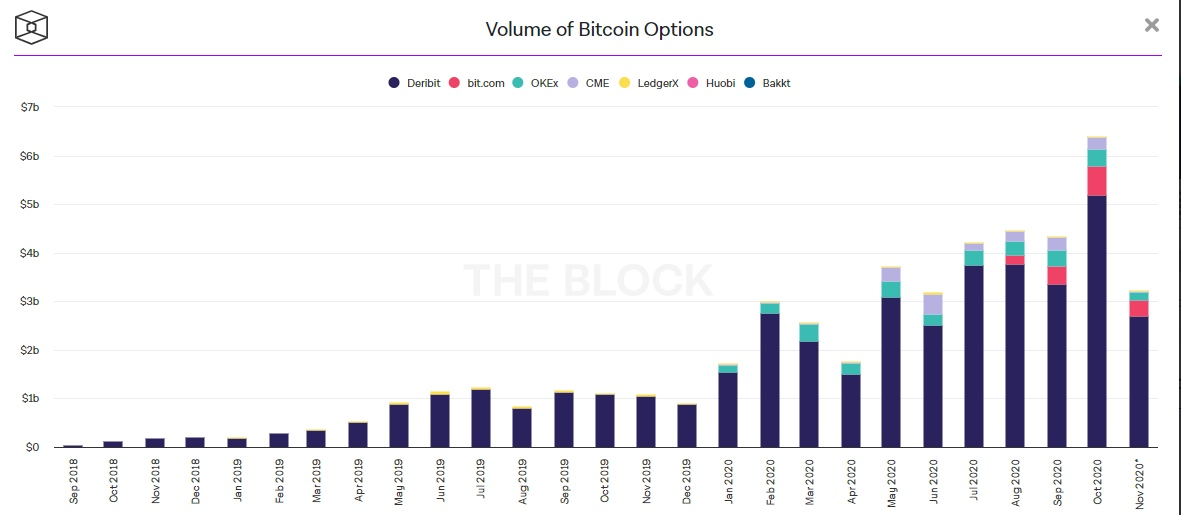

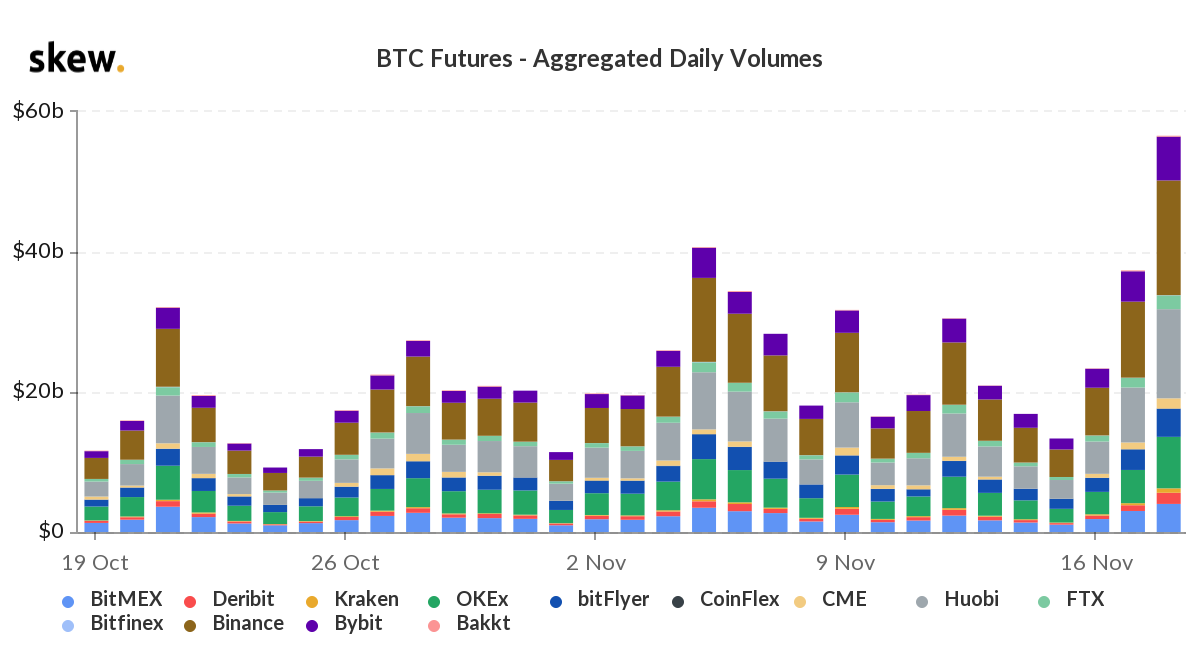

- Bitcoin Volume Option: how much trading in Bitcoin is happening. Can give a rough idea regarding the involvement of institutions and retailers.

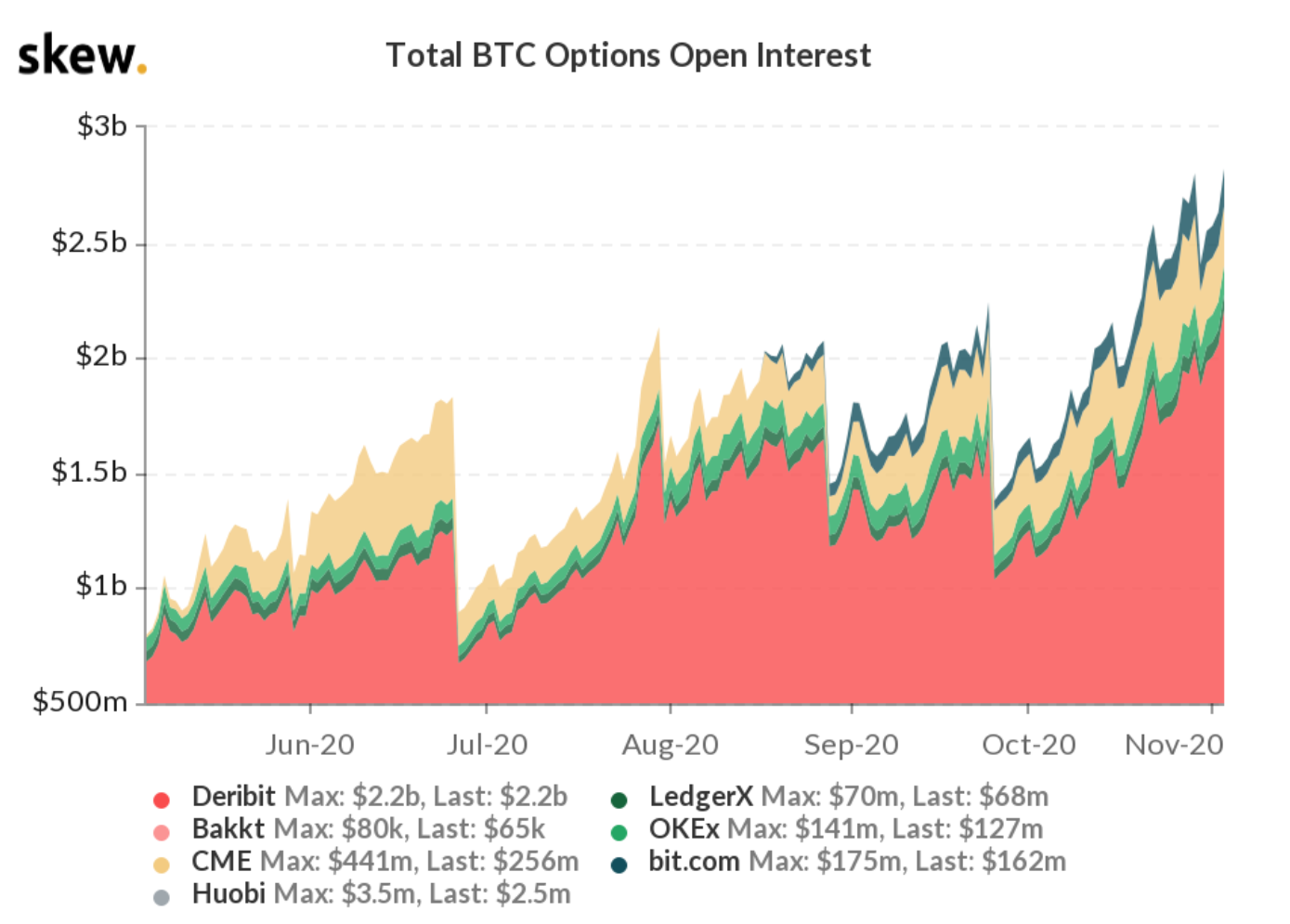

- Open interest Options: It’s a major indicator as too, who are the ones investing.

- Block trades: A sure shot way to gauge the involvement of institutional players.

- Bitcoin price: Volatility can attract different kinds of investments.

It is important to understand that institutional investors pouring money into the Bitcoin market are still at very nascent stages. The traditional players, which are the retail buyers and sellers, maintain their stronghold. However, recent trends show that institutional interest is high and rising.

Let us look at certain aspects of Bitcoin trading and then try to understand what these indicate in terms of institutional and retail participation.

What Story Does Options Volume Tell?

Reported volume of bitcoin is often not a good indicator as it can be misleading but gives a picture of the market. A more exact indicator is the Bitcoin moving to and fro from particular derivative exchanges. Bitcoin options volumes have seen a 1,000% rise on CME in May, but they dropped 35.7% the following month. Still, the total option volumes set a record monthly high.

Source: www.skew.com

Does Open Interest Give a Clearer Picture?

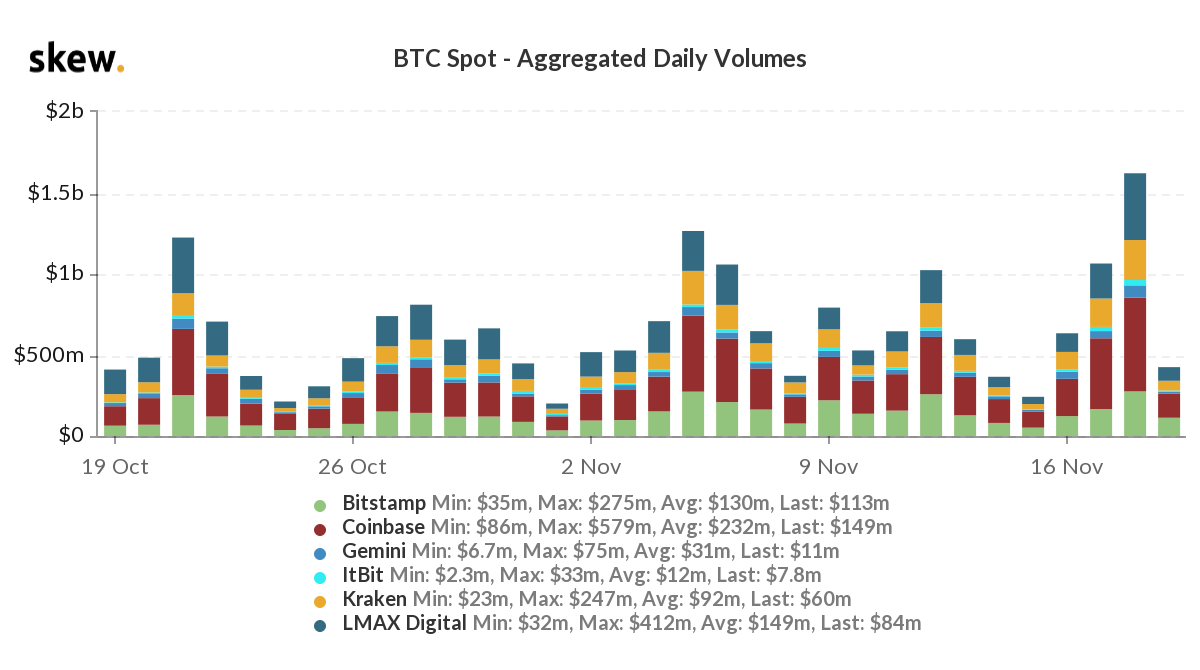

Increasing volume is an indicator of rising interest from both institutions and retailers. Usually to shelter assets during this global COVID-19 pandemic and also an emerging global financial crisis. At the same time, open interest is a strong indicator of the involvement of the institutional players. It indicates buy-side interests and is a pretty solid metric to make such distinctions as opposed to volumes.

It is worth noting that large open interest holders (traders with 25 or more contracts) went to an average of 65 in Q2 2020. It is a huge jump of 27% from Q1 2020 and incidentally a record in itself. It’s cited from the CME group listings.

Large open interest traders are basically big traders and can be an indicator of an increase in institutional participation.

Source: www.skew.com

Block Trades and What We Can Gauge From Them

Block trades are always carried out on the sidelines away from the public market. They are privately negotiated contracts that have to meet a certain quantity threshold to qualify for execution. This is obviously not really in the hands of retail buyer-sellers, and mostly for large traders and institutions, Hence the percentage of block trades in the overall volume is a strong indicator that the institutions are rising to participate more in the Bitcoin revolution.

Since January 2020, the percentage of blocks in the options volume has been on the rise steadily. So the increase in institutional participation is all but certain now.

Bitcoin Price and Its Volatile Nature

Bitcoin price goes up and down frequently. It is extremely volatile. It has always seen massive highs coupled with equally massive drops. But the trend in 2020 has been somewhat encouraging. The volatility of Bitcoin has seen a bit of dampening. It is again a good sign for institutional players’ involvement because institutions prefer stable markets. Wild swings in the market do happen, but they are mostly retail-driven ones. The stability in the Bitcoin market is also a very positive sign as it means it is slowly transcending to an asset class.

Currently, traditional markets see an increase in volatility, which has motivated the institutions to diversify and try other markets, too Bitcoin being among the top choices.

Still, the decrease in the Bitcoin price volatility alone is not enough to warrant the conclusion that institutional players have come to the field.

The Bitcoins futures curves are quite steep. Institutional players are very much aware of this news. Along with the Bitcoin stability this year, things look way too lucrative to let them pass by simply. In fact, it has been more stable than many technology stocks and other commodities this year. It has further piqued the interest of institutions. Given the present circumstances with the Global pandemic, institutions broaden their horizons and increase their risk-taking practices. Their foray into the Bitcoin market is unmistakable, and it is most likely not a temporary but a permanent one.

The Bottom Line

Global giants are beginning to pop up. Grayscale Bitcoin Trust is one such example. They have earned a reputation for themselves in the bitcoin market and are a force to reckon with. Traditional players like the Big firms (Deloitte, PwC, Ernst & Young (EY), and KPMG) and also Western Union are making a jump into the crypto market, specifically the Bitcoin market. This change is noticeable on platforms like TradeBlock.

Deribit, which is the largest platform for Bitcoin, also confirms institutional involvement. The latest news to come out is that even PayPal is considering allowing payments using Bitcoin.

With so many big companies taking an active interest in understanding and foraging into the world of Bitcoin, it is safe to say that this interest is only going to grow as we race towards the future.